snohomish property tax rate

First half tax payments made after that date will need to include any interest or penalties. The Snohomish Washington sales tax is 910 consisting of 650 Washington state sales tax and 260 Snohomish local sales taxesThe local sales tax consists of a 260 city sales tax.

How To Read Your Property Tax Statement Snohomish County Wa Official Website

Snohomish WA 98291-1589 Utility Payments PO.

. Delinquent Late Penalties. Snohomish County Government 3000 Rockefeller Avenue Everett WA. What is the property tax rate in Snohomish County.

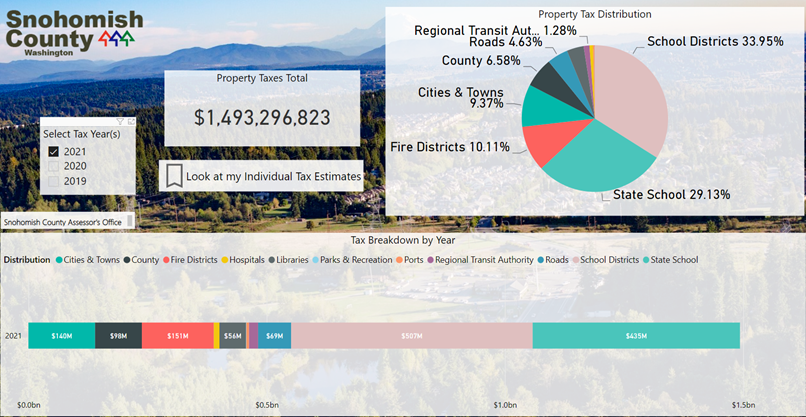

Property taxes have increased across Snohomish County due voter approved tax measures and school levies that will go in affect in 2020. Come to the Treasurers Office to pay your taxes by cash check money order debit or credit card with convenience fee at the counter in the Snohomish County Administration East building on the first floor. Levy Division Email the Levy Division 3000 Rockefeller Ave.

In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. How Do I Find My Snohomish County Parcel Id. The Washington sales tax rate is currently 65.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate. Snohomish Countys average tax rate is 089 of assessed home values which is well below the national average of 11 and slightly below the Washington statewide average of 092. Types of county reports include.

The Snohomish sales tax rate is 28. The Department of Revenue oversees the administration of property taxes at state and local levels. MS 510 Everett WA 98201-4046 Ph.

Based on that 089 rate Snohomish County homeowners can expect to pay an average of 3009 a year in property. Box 1589 Snohomish WA 98291-1589. Delinquent late payment of taxes are subject to interest at the rate of 12 per year 1 for each month of delinquency from the month of delinquency until paid.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value. Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. In addition all delinquent taxes are subject to penalties as follows.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. No call is required for payment of current year taxes. Several fields appear along the middle of the page underneath Property.

Snohomish County Assessor 3000 Rockefeller Avenue Everett. Offered by County of Snohomish Washington. How was your experience with papergov.

Groceries are exempt from the Snohomish and Washington state sales taxes. Non-rta Washington sales tax is 890 consisting of 650 Washington state sales tax and 240 Snohomish County Unincorp. In this mainly budgetary function county and local public leaders estimate annual spending.

Though not uncommon for Snohomish County residents to approve levies and tax measures its that these increases have caught residents off guard due with their size and those residents have been voicing frustration across. Our mailing address. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

Average Effective Property Tax Rate. You may drop tax payments in the secure drop box during the months of April and October. In this mainly budgetary function county and local public leaders estimate annual spending.

The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value. Apply for a Business License. The Treasurer calculates the taxes due and sends out the tax notices using the taxing district information.

Non-rta local sales taxesThe local sales tax consists of a 240 special district sales tax used to fund. Snohomish County Treasurer Updates. The Snohomish Sales Tax is collected by the merchant on all qualifying sales made within Snohomish.

The minimum combined 2022 sales tax rate for Snohomish Washington is 93. The median property tax on a 33860000 house is 355530 in the United States. If the first half tax is not paid by April 30 the full amount becomes delinquent.

Apply for a Pet License. Ad Research Is the First Step to Lowering Your Property Taxes. The median property tax on a 33860000 house is 311512 in Washington.

The County sales tax rate is 0. Browse Current and Historical Documents Including County Property Assessments Taxes. On the Property Account Summary page it may also be found the neighborhood ID.

The first half 2022 property taxes were due April 30th 2022. The assessed value of your property is multiplied by the tax rate necessary in your levy area to produce your fair share of the total levied tax by these jurisdictions. The median property tax on a 33860000 house is 301354 in Snohomish County.

Individual Program Review of a single area of property. When summed up the property tax burden all owners shoulder is created. Snohomish WA 98291-1589 Utility Payments PO.

The Snohomish County Unincorp. The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093. This is the total of state county and city sales tax rates.

Enter Your Address to Begin. Popular in County of Snohomish. The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median.

Email the Property Tax Exemptions Division. Did South Dakota v. Download all Washington sales tax rates by zip code.

2022 taxes are available to view or pay online here. Explore important tax information of Snohomish. The minimum combined 2022 sales tax rate for Snohomish Washington is 93.

Snohomish County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. What is the sales tax rate in Snohomish Washington.

Graduated Real Estate Tax Reet For Snohomish County

Snohomish County Including Unincorporated Snohomish County South Of The Stillaquamish River Brier Lynnwood East Of Hwy 99 And Gold Bar Washington Waste Management Northwest

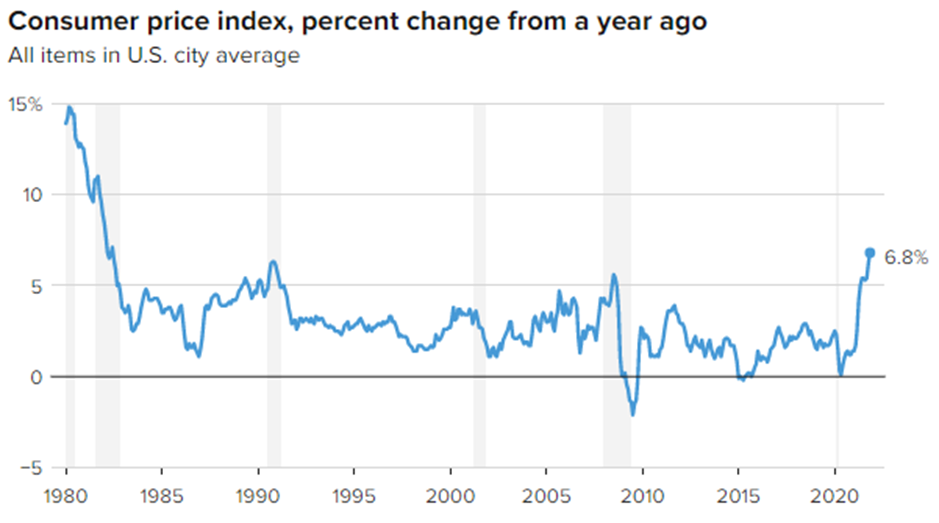

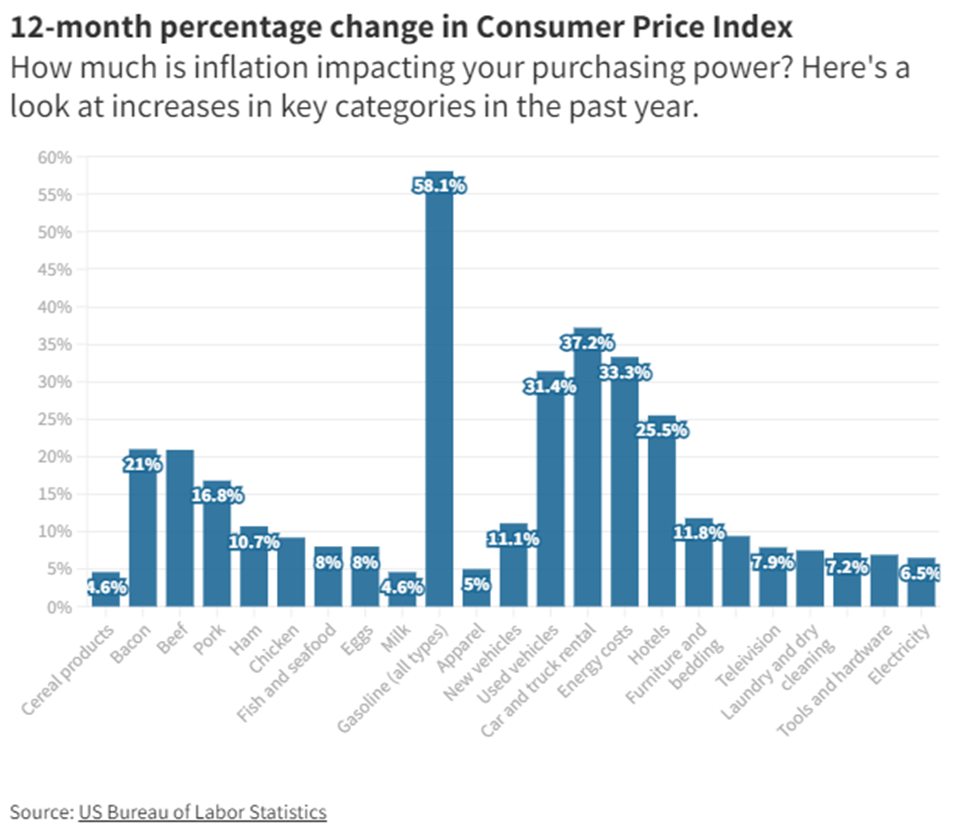

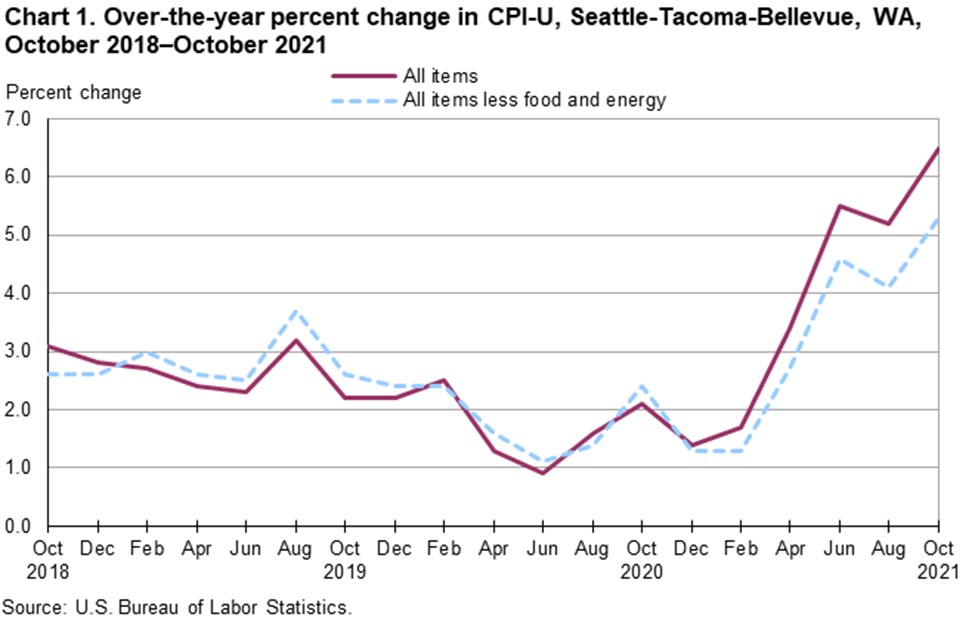

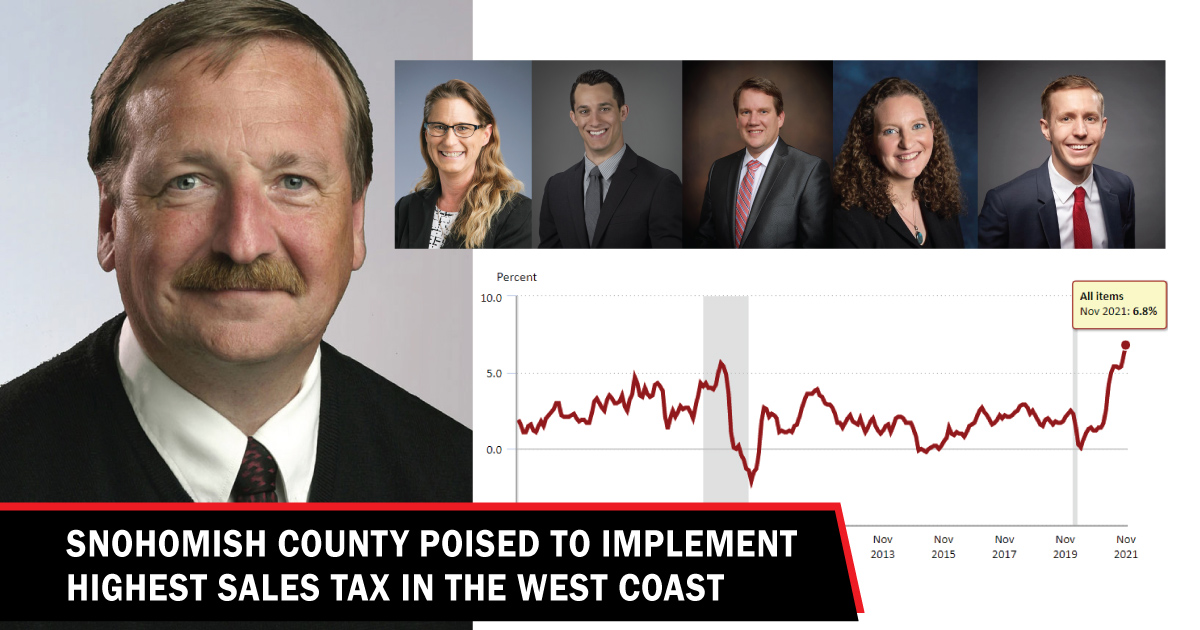

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

How To Read Your Property Tax Statement Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

News Flash Snohomish County Wa Civicengage

Mountlake Terrace City Council Approves Property Tax Increase Code Updates Mltnews Com

Snohomish County Home Values Soar In Latest Assessment Heraldnet Com

News Flash Snohomish County Wa Civicengage

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Property Mls 1693341 10413 240th Place Sw Edmonds Wa 98020 In Snohomish County Wa Has 4 Bedrooms 1 Backyard Views Low Maintenance Yard Real Estate Trends